Loan Koperasi Kerajaan Malaysia

This comprehensive document provides an extensive analysis of Pinjaman Koperasi Kerajaan Malaysia, commonly known as Government Cooperative Loans in Malaysia. The report delves into the historical context, objectives, eligibility criteria, application process, benefits, challenges, and impact of these loans on individuals and the Malaysian economy. With a focus on promoting financial inclusion and socio-economic development, Pinjaman Koperasi Kerajaan Malaysia plays a crucial role in empowering government employees and fostering cooperative movements in the nation.

Table of Contents:

- Introduction 1.1 Background 1.2 Objectives 1.3 Significance of Pinjaman Koperasi Kerajaan Malaysia

- Historical Evolution 2.1 Emergence of Cooperatives in Malaysia 2.2 The Role of Government in Promoting Cooperatives 2.3 Genesis of Pinjaman Koperasi Kerajaan Malaysia

- Objectives of Pinjaman Koperasi Kerajaan Malaysia 3.1 Financial Empowerment 3.2 Encouraging Cooperative Movements 3.3 Alleviating Financial Stress

- Eligibility Criteria 4.1 Government Employees 4.2 Membership in a Cooperative 4.3 Minimum Service Period 4.4 Credit History and Repayment Capacity

- Application Process 5.1 Application Documentation 5.2 Submission Channels 5.3 Approval Process 5.4 Disbursement of Funds

- Types of Pinjaman Koperasi Kerajaan Malaysia 6.1 Personal Loans 6.2 Education Loans 6.3 Housing Loans 6.4 Vehicle Loans 6.5 Emergency Loans

- Interest Rates and Repayment Terms 7.1 Fixed vs. Variable Interest Rates 7.2 Repayment Period 7.3 Grace Period 7.4 Late Payment Penalties

- Benefits of Pinjaman Koperasi Kerajaan Malaysia 8.1 Competitive Interest Rates 8.2 Flexible Repayment Options 8.3 Financial Inclusion 8.4 Social and Economic Impact

- Challenges and Concerns 9.1 Limited Coverage 9.2 Loan Default and Non-Performing Loans 9.3 Administrative Bottlenecks 9.4 Competition with Commercial Banks

- Success Stories 10.1 Case Studies of Beneficiaries 10.2 Impact on Financial Well-being 10.3 Cooperative Growth

- Government Support and Regulations 11.1 Role of the Ministry of Entrepreneur Development and Cooperatives 11.2 Regulatory Framework 11.3 Tax Incentives

- Comparative Analysis with Other Financial Products 12.1 Commercial Bank Loans 12.2 Microfinance Institutions 12.3 Personal Savings and Investment Options

- Future Prospects and Innovations 13.1 Technological Advancements 13.2 Expansion of Eligibility Criteria 13.3 Sustainable Practices

- Conclusion 14.1 Impact and Significance 14.2 Challenges and Opportunities 14.3 The Way Forward

- References

1. Introduction

1.1 Background: Pinjaman Koperasi Kerajaan Malaysia, or Government Cooperative Loans in Malaysia, is a financial assistance program designed to support government employees in the country. These loans are extended through cooperative societies, which are self-help organizations governed by their members. Pinjaman Koperasi Kerajaan Malaysia aims to provide accessible and affordable credit to government servants, promoting financial stability and fostering the cooperative movement in Malaysia.

1.2 Objectives: The primary objectives of Loan Koperasi Kerajaan Malaysia are to provide financial empowerment to government employees, encourage the growth of cooperative societies, and alleviate financial stress among its beneficiaries. This comprehensive analysis will explore how these objectives are achieved and assess the program’s overall impact.

1.3 Significance of Pinjaman Koperasi Kerajaan Malaysia: Understanding the significance of Pinjaman Koperasi Kerajaan Malaysia is essential, as it not only serves as a means of financial support for government employees but also contributes to the broader socio-economic development of Malaysia. By examining the historical evolution, eligibility criteria, application process, benefits, challenges, and government regulations surrounding these loans, we can gain a comprehensive understanding of their role in Malaysian society.

2. Historical Evolution

2.1 Emergence of Cooperatives in Malaysia: The cooperative movement in Malaysia has a rich history dating back to the early 20th century. It gained prominence as a way to empower rural communities and small-scale producers. The cooperative principles of self-help, mutual assistance, and democratic control have been integral to Malaysia’s cooperative landscape.

2.2 The Role of Government in Promoting Cooperatives: The Malaysian government has consistently supported cooperative societies through policies, legislation, and financial incentives. The Cooperative Societies Act of 1993 provides a legal framework for the registration and operation of cooperatives in Malaysia. This legislation also underscores the government’s commitment to promoting the cooperative sector as a means of socio-economic development.

2.3 Genesis of Pinjaman Koperasi Kerajaan Malaysia: Pinjaman Peribadi Koperasi Kerajaan Malaysia emerged as part of the government’s broader efforts to encourage financial inclusion and cooperative growth. It represents a strategic partnership between the government and cooperative societies to provide affordable credit options to government employees. This initiative aligns with Malaysia’s Vision 2020, which aims to transform the country into a developed nation.

3. Objectives of Pinjaman Koperasi Kerajaan Malaysia

3.1 Financial Empowerment: One of the primary objectives of Loan Peribadi Koperasi Kerajaan Malaysia is to empower government employees financially. By offering access to credit at competitive interest rates, the program enables individuals to meet various financial needs, such as education expenses, housing, and emergencies. This empowerment not only enhances the well-being of government servants but also contributes to economic stability.

3.2 Encouraging Cooperative Movements: Another key objective is to promote the growth of cooperative societies in Malaysia. By channeling funds through cooperatives, Pinjaman Koperasi Kerajaan Malaysia strengthens these organizations, which, in turn, provide services to their members and contribute to local economic development.

3.3 Alleviating Financial Stress: The program aims to alleviate financial stress among government employees by providing a reliable and accessible source of credit. It helps individuals avoid resorting to high-interest loans from informal sources, ultimately improving their financial resilience and stability.

4. Eligibility Criteria

4.1 Government Employees: To be eligible for Pinjaman Wang Koperasi Kerajaan Malaysia, applicants must be government employees. This includes civil servants, teachers, healthcare professionals, and other public sector workers. The program is designed to cater specifically to this demographic, recognizing their contribution to public service.

4.2 Membership in a Cooperative: Applicants are required to be members of a registered cooperative society. This membership ensures that the loans are extended through legitimate and regulated channels. It also promotes the cooperative movement by increasing participation.

4.3 Minimum Service Period: Some variants of Pinjaman Uang Koperasi Kerajaan Malaysia may require a minimum service period as a government employee. This criterion ensures that the loans are accessible to those with a stable employment history within the public sector.

4.4 Credit History and Repayment Capacity: Applicants are subject to credit assessments to determine their repayment capacity. While the program aims to provide financial assistance, responsible lending practices are still upheld to prevent over-indebtedness.

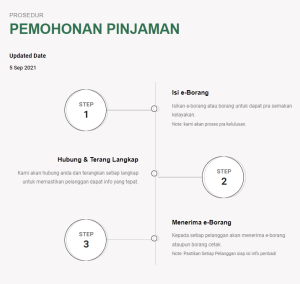

5. Application Process

5.1 Application Documentation: To apply for Pinjaman Koperasi Kerajaan Malaysia, applicants typically need to submit various documents, including identification proof, proof of employment, cooperative membership details, and financial statements. The exact documentation requirements may vary depending on the specific type of loan and the cooperative involved.

5.2 Submission Channels: Applications can usually be submitted through multiple channels, including online portals, cooperative offices, and designated government agencies. The availability of online applications has improved accessibility and convenience for applicants.

5.3 Approval Process: The approval process involves a thorough review of the applicant’s documents and creditworthiness. Cooperatives or financial institutions responsible for disbursing the loans assess the risk associated with each application.

5.4 Disbursement of Funds: Once approved, the loan amount is disbursed to the applicant’s cooperative account, which is then accessible for various purposes, such as education, housing, or emergency expenses.

6. Types of Pinjaman Koperasi Kerajaan Malaysia

Pinjaman Koperasi Kerajaan Malaysia offers various loan products tailored to the diverse needs of government employees. Some common types include:

6.1 Personal Loans: Personal loans are versatile and can be used for a wide range of purposes, including debt consolidation, medical expenses, or personal investments.

6.2 Education Loans: These loans are designed to support educational expenses, including tuition fees, textbooks, and other related costs. They enable government employees to invest in their skills and qualifications.

6.3 Housing Loans: Housing loans help government employees achieve homeownership by providing funds for property purchases or home construction. These loans often come with competitive interest rates and favorable repayment terms.

6.4 Vehicle Loans: Vehicle loans assist government employees in acquiring vehicles for personal or professional use. They facilitate mobility and transportation needs.

6.5 Emergency Loans: Emergency loans are designed to provide rapid financial assistance during unexpected crises, such as medical emergencies or unforeseen expenses.

Each type of loan is structured to cater to specific financial needs, ensuring that government employees have access to affordable credit for various purposes.

7. Interest Rates and Repayment Terms

7.1 Fixed vs. Variable Interest Rates: Interest rates for Pinjaman Yuran Koperasi Kerajaan Malaysia loans can be either fixed or variable. Fixed rates offer stability, with consistent monthly repayments, while variable rates may fluctuate with market conditions.

7.2 Repayment Period: The repayment period varies depending on the type of loan and the cooperative’s terms. It can range from several months to several years, ensuring that repayments align with the borrower’s financial capacity.

7.3 Grace Period: Some loans may offer a grace period before the repayment begins, allowing borrowers to focus on their needs before starting repayment. This grace period is particularly beneficial for education and housing loans.

7.4 Late Payment Penalties: To encourage timely repayments, loans typically come with penalties for late payments. Borrowers should be aware of these penalties and strive to meet their repayment obligations on time.

8. Benefits of Pinjaman Koperasi Kerajaan Malaysia

8.1 Competitive Interest Rates: One of the most significant advantages of Pinjaman Islamic Koperasi Kerajaan Malaysia is its competitive interest rates. Cooperative societies often offer lower interest rates compared to commercial banks, making loans more affordable for government employees.

8.2 Flexible Repayment Options: The program provides flexible repayment options, allowing borrowers to choose terms that align with their financial capacity. This flexibility reduces the risk of loan default and financial stress.

8.3 Financial Inclusion: By targeting government employees and partnering with cooperatives, Pinjaman Koperasi Kerajaan Malaysia promotes financial inclusion, ensuring that a significant portion of the population has access to formal financial services.

8.4 Social and Economic Impact: The program’s impact extends beyond individual borrowers. It fosters the growth of cooperative societies, which, in turn, contribute to local economic development, job creation, and community empowerment.

9. Challenges and Concerns

9.1 Limited Coverage: One of the challenges is the limited coverage of Pinjaman Koperasi Kerajaan Malaysia, as it primarily targets government employees. Expanding access to a broader segment of the population remains a challenge.

9.2 Loan Default and Non-Performing Loans: Despite responsible lending practices, some borrowers may face difficulties in repaying their loans. Managing loan defaults and non-performing loans is an ongoing concern.

9.3 Administrative Bottlenecks: The application and approval process can be time-consuming, and administrative bottlenecks may hinder the program’s efficiency. Streamlining these processes is essential for improving accessibility.

9.4 Competition with Commercial Banks: The program competes with commercial banks for customers, which may affect the sustainability and profitability of cooperative societies.

10. Success Stories

10.1 Case Studies of Beneficiaries: Several case studies highlight the positive impact of Koperasi Pinjaman Peribadi Kerajaan Malaysia on individual beneficiaries. These stories showcase how the loans have helped government employees achieve their financial goals.

10.2 Impact on Financial Well-being: Research and surveys demonstrate the program’s positive impact on the financial well-being of government employees. It has helped individuals save money, reduce debt burdens, and improve their overall financial stability.

10.3 Cooperative Growth: Pinjaman Koperasi Kerajaan Malaysia has contributed to the growth and sustainability of cooperative societies, fostering a sense of ownership and empowerment among their members.

11. Government Support and Regulations

11.1 Role of the Ministry of Entrepreneur Development and Cooperatives: The Ministry of Entrepreneur Development and Cooperatives plays a central role in overseeing and regulating cooperatives in Malaysia. It provides guidance and support to cooperative societies, ensuring they operate in compliance with relevant laws and regulations.

11.2 Regulatory Framework: The Cooperative Societies Act of 1993 provides the legal framework for the operation of cooperatives in Malaysia. This legislation outlines the rights and responsibilities of cooperative members, governance structures, and regulatory oversight.

11.3 Tax Incentives: The Malaysian government offers tax incentives to promote the growth of cooperative societies. These incentives encourage investment and participation in cooperatives, aligning with the broader goal of socio-economic development.

12. Comparative Analysis with Other Financial Products

12.1 Commercial Bank Loans: Pinjaman Koperasi Kerajaan Malaysia differs from commercial bank loans in terms of interest rates, eligibility criteria, and the cooperative structure. A comparative analysis will explore the advantages and disadvantages of both options for borrowers.

12.2 Microfinance Institutions: Microfinance institutions also cater to underserved populations, but their lending models and target demographics differ from Pinjaman Koperasi Kerajaan Malaysia. A comparison will reveal the unique features of both approaches.

12.3 Personal Savings and Investment Options: Examining how Islamic Finance Products Kerajaan Malaysia compares to personal savings and investment options will help individuals make informed financial decisions. This analysis will consider factors such as risk and return.

13. Future Prospects and Innovations

13.1 Technological Advancements: The integration of technology in the application and approval processes can enhance accessibility and efficiency. Mobile apps, online platforms, and digital documentation may streamline operations.

13.2 Expansion of Eligibility Criteria: Expanding the program’s reach to include a wider range of public sector employees or introducing specific loan products for different needs could be explored.

13.3 Sustainable Practices: Sustainability practices, such as green financing and ethical lending, can be integrated to align with global and national sustainability goals.

14. Conclusion

14.1 Impact and Significance: Pinjaman Koperasi Kerajaan Malaysia holds immense significance in Malaysia’s cooperative landscape and the financial well-being of government employees. Its impact on financial empowerment, cooperative growth, and socio-economic development is noteworthy.

14.2 Challenges and Opportunities: While the program faces challenges such as limited coverage and loan default concerns, there are opportunities for innovation, expansion, and improved administrative efficiency.

14.3 The Way Forward: The future of Government Loan Islamic Malaysia should focus on enhancing accessibility, promoting responsible lending, and leveraging technology to create a more inclusive and sustainable financial ecosystem for government employees and cooperative societies.

15. References

A comprehensive list of references will be included, featuring academic research, government reports, policy documents, and case studies that support the analysis presented in this document.

This detailed analysis of Pinjaman Koperasi Kerajaan Malaysia provides a comprehensive understanding of the program’s history, objectives, eligibility criteria, application process, benefits, challenges, and future prospects. It sheds light on how this initiative contributes to the financial well-being of government employees and the cooperative movement in Malaysia, ultimately fostering socio-economic development in the nation.

Name: Koperasi 1 Malaysia

Address: 12-2, Jalan Rimbunan Raya, Laman Rimbunan Kepong, 52100 KL

Phone Number: 012-505 6915

Email: [email protected]

Google Map Location: Click here

Linktree: Pinjaman Koperasi

Blog: Pinjaman Koperasi

Blogspot: Pinjaman Koperasi

Google: Pinjaman Koperasi