Pinjaman peribadi terbaik untuk kakitangan kerajaan

Dokumen komprehensif ini menyediakan analisis yang meluas mengenai Pinjaman Koperasi Kerajaan Malaysia, yang biasanya dikenali sebagai Pinjaman Koperasi Kerajaan di Malaysia. Laporan itu menyelidiki konteks sejarah, objektif, kriteria kelayakan, proses permohonan, faedah, cabaran dan kesan pinjaman ini terhadap individu dan ekonomi Malaysia. Dengan tumpuan untuk menggalakkan rangkuman kewangan dan pembangunan sosio-ekonomi, Pinjaman Koperasi Kerajaan Malaysia memainkan peranan penting dalam memperkasa kakitangan kerajaan dan memupuk gerakan koperasi di negara ini.

Isi kandungan:

pengenalan

1.1 Latar Belakang

1.2 Objektif

1.3 Kepentingan Pinjaman Koperasi Kerajaan Malaysia

Evolusi Sejarah

2.1 Kemunculan Koperasi di Malaysia

2.2 Peranan Kerajaan dalam Memajukan Koperasi

2.3 Kejadian Pinjaman Koperasi Kerajaan Malaysia

Objektif Pinjaman Koperasi Kerajaan Malaysia

3.1 Pemerkasaan Kewangan

3.2 Menggalakkan Gerakan Koperasi

3.3 Mengurangkan Tekanan Kewangan

Kriteria Kelayakan

4.1 Kakitangan Kerajaan

4.2 Keahlian dalam Koperasi

4.3 Tempoh Perkhidmatan Minimum

4.4 Sejarah Kredit dan Kapasiti Pembayaran Balik

Proses permohonan

5.1 Dokumentasi Permohonan

5.2 Saluran Penyerahan

5.3 Proses Kelulusan

5.4 Pengeluaran Dana

Jenis Pinjaman Koperasi Kerajaan Malaysia

6.1 Pinjaman Peribadi

6.2 Pinjaman Pendidikan

6.3 Pinjaman Perumahan

6.4 Pinjaman Kenderaan

6.5 Pinjaman Kecemasan

Kadar Faedah dan Syarat Pembayaran Balik

7.1 Kadar Faedah Tetap lwn. Berubah

7.2 Tempoh Bayaran Balik

7.3 Tempoh Ihsan

7.4 Penalti Pembayaran Lewat

Faedah Pinjaman Koperasi Kerajaan Malaysia

8.1 Kadar Faedah Berdaya saing

8.2 Pilihan Pembayaran Balik Fleksibel

8.3 Rangkuman Kewangan

8.4 Kesan Sosial dan Ekonomi

Cabaran dan Kebimbangan

9.1 Liputan Terhad

9.2 Pinjaman Ingkar dan Pinjaman Tidak Berbayar

9.3 Kesesakan Pentadbiran

9.4 Persaingan dengan Bank Perdagangan

Kisah Kejayaan

10.1 Kajian Kes Penerima

10.2 Kesan terhadap Kesejahteraan Kewangan

10.3 Pertumbuhan Koperasi

Sokongan dan Peraturan Kerajaan

11.1 Peranan Kementerian Pembangunan Usahawan dan Koperasi

11.2 Rangka Kerja Kawal Selia

11.3 Insentif Cukai

Analisis Perbandingan dengan Produk Kewangan Lain

12.1 Pinjaman Bank Perdagangan

12.2 Institusi Kewangan Mikro

12.3 Pilihan Simpanan dan Pelaburan Peribadi

Prospek dan Inovasi Masa Depan

13.1 Kemajuan Teknologi

13.2 Perluasan Kriteria Kelayakan

13.3 Amalan Lestari

Kesimpulan

14.1 Kesan dan Kepentingan

14.2 Cabaran dan Peluang

14.3 Jalan Hadapan

Rujukan

- Pengenalan

1.1 Latar Belakang:

Pinjaman Koperasi Kerajaan Malaysia, atau Pinjaman Koperasi Kerajaan di Malaysia, ialah program bantuan kewangan yang direka untuk menyokong kakitangan kerajaan di negara ini. Pinjaman ini diberikan melalui koperasi, yang merupakan organisasi bantu diri yang ditadbir oleh ahli mereka. Pinjaman Koperasi Kerajaan Malaysia bertujuan untuk menyediakan kredit yang boleh diakses dan berpatutan kepada penjawat kerajaan, menggalakkan kestabilan kewangan dan memupuk gerakan koperasi di Malaysia.

1.2 Objektif:

Objektif utama Pinjaman Koperasi Kerajaan Malaysia adalah untuk menyediakan pemerkasaan kewangan kepada kakitangan kerajaan, menggalakkan pertumbuhan koperasi, dan mengurangkan tekanan kewangan di kalangan penerimanya. Analisis komprehensif ini akan meneroka bagaimana objektif ini dicapai dan menilai kesan keseluruhan program.

1.3 Kepentingan Pinjaman Koperasi Kerajaan Malaysia:

Memahami kepentingan loan Koperasi Kerajaan Malaysia adalah penting, kerana ia bukan sahaja berfungsi sebagai alat sokongan kewangan untuk kakitangan kerajaan tetapi juga menyumbang kepada pembangunan sosio-ekonomi Malaysia yang lebih luas. Dengan meneliti sejarah evolusi, kriteria kelayakan, proses permohonan, faedah, cabaran dan peraturan kerajaan yang mengelilingi pinjaman ini, kita boleh memperoleh pemahaman yang menyeluruh tentang peranan mereka dalam masyarakat Malaysia.

Loan Koperasi

- Evolusi Sejarah

2.1 Kemunculan Koperasi di Malaysia:

Gerakan koperasi di Malaysia mempunyai sejarah yang kaya sejak awal abad ke-20. Ia menjadi terkenal sebagai satu cara untuk memperkasakan masyarakat luar bandar dan pengeluar berskala kecil. Prinsip koperasi bantu diri, bantuan bersama, dan kawalan demokrasi telah menjadi sebahagian daripada landskap koperasi Malaysia.

2.2 Peranan Kerajaan dalam Memajukan Koperasi:

Kerajaan Malaysia secara konsisten menyokong koperasi melalui dasar, perundangan dan insentif kewangan. Akta Koperasi 1993 menyediakan rangka kerja perundangan untuk pendaftaran dan operasi koperasi di Malaysia. Perundangan ini juga menggariskan komitmen kerajaan untuk mempromosikan sektor koperasi sebagai sarana pembangunan sosio-ekonomi.

2.3 Kejadian Pinjaman Koperasi Kerajaan Malaysia:

Pinjaman Koperasi Kerajaan Malaysia muncul sebagai sebahagian daripada usaha kerajaan yang lebih meluas untuk menggalakkan rangkuman kewangan dan pertumbuhan koperasi. Ia mewakili perkongsian strategik antara kerajaan dan koperasi untuk menyediakan pilihan kredit yang berpatutan kepada kakitangan kerajaan. Inisiatif ini selaras dengan Wawasan 2020 Malaysia, yang bertujuan untuk mengubah negara menjadi sebuah negara maju.

- Objektif Pinjaman Koperasi Kerajaan Malaysia

3.1 Pemerkasaan Kewangan:

Salah satu objektif utama Pinjaman Koperasi Kerajaan Malaysia adalah untuk memperkasakan kakitangan kerajaan dari segi kewangan. Dengan menawarkan akses kepada kredit pada kadar faedah yang kompetitif, program ini membolehkan individu memenuhi pelbagai keperluan kewangan, seperti perbelanjaan pendidikan, perumahan dan kecemasan. Pemerkasaan ini bukan sahaja meningkatkan kesejahteraan penjawat kerajaan tetapi juga menyumbang kepada kestabilan ekonomi.

3.2 Menggalakkan Gerakan Koperasi:

Satu lagi objektif utama adalah untuk menggalakkan pertumbuhan koperasi di Malaysia. Dengan menyalurkan dana melalui koperasi, Pinjaman Koperasi Kerajaan Malaysia memperkukuh pertubuhan-pertubuhan ini, yang seterusnya memberi perkhidmatan kepada ahli-ahli mereka dan menyumbang kepada pembangunan ekonomi tempatan.

3.3 Mengurangkan Tekanan Kewangan:

Program ini bertujuan untuk mengurangkan tekanan kewangan dalam kalangan kakitangan kerajaan dengan menyediakan sumber kredit yang boleh dipercayai dan boleh diakses. Ia membantu individu mengelak daripada menggunakan pinjaman berfaedah tinggi daripada sumber tidak formal, akhirnya meningkatkan daya tahan dan kestabilan kewangan mereka.

- Kriteria Kelayakan

4.1 Kakitangan Kerajaan:

Untuk layak mendapat Pinjaman Koperasi Kerajaan Malaysia, pemohon mestilah kakitangan kerajaan. Ini termasuk penjawat awam, guru, profesional penjagaan kesihatan dan pekerja sektor awam yang lain. Program ini direka untuk memenuhi demografi ini secara khusus, mengiktiraf sumbangan mereka kepada perkhidmatan awam.

4.2 Keahlian dalam Koperasi:

Pemohon dikehendaki menjadi ahli koperasi berdaftar. Keahlian ini memastikan pinjaman dilanjutkan melalui saluran yang sah dan terkawal. Ia juga menggalakkan gerakan koperasi dengan meningkatkan penyertaan.

4.3 Tempoh Perkhidmatan Minimum:

Sesetengah varian Pinjaman Koperasi Kerajaan Malaysia mungkin memerlukan tempoh perkhidmatan minimum sebagai kakitangan kerajaan. Kriteria ini memastikan bahawa pinjaman boleh diakses oleh mereka yang mempunyai sejarah pekerjaan yang stabil dalam sektor awam.

4.4 Sejarah Kredit dan Kapasiti Pembayaran Balik:

Pemohon tertakluk kepada penilaian kredit untuk menentukan kapasiti pembayaran balik mereka. Walaupun program ini bertujuan untuk menyediakan bantuan kewangan, amalan pemberian pinjaman yang bertanggungjawab masih dipertahankan untuk mengelakkan keterlaluan berhutang.

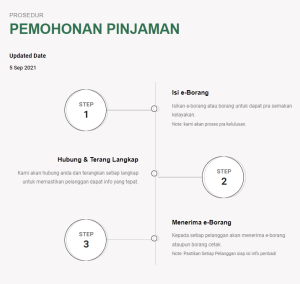

5.1 Dokumentasi Permohonan:

Untuk memohon Pinjaman Koperasi Kerajaan Malaysia, pemohon lazimnya perlu mengemukakan pelbagai dokumen, termasuk bukti pengenalan diri, bukti pekerjaan, butiran keahlian koperasi dan penyata kewangan. Keperluan dokumentasi yang tepat mungkin berbeza bergantung pada jenis pinjaman tertentu dan koperasi yang terlibat.

5.2 Saluran Penyerahan:

Permohonan biasanya boleh dihantar melalui pelbagai saluran, termasuk portal dalam talian, pejabat koperasi, dan agensi kerajaan yang ditetapkan. Ketersediaan aplikasi dalam talian telah meningkatkan kebolehcapaian dan kemudahan bagi pemohon.

5.3 Proses Kelulusan:

Proses kelulusan melibatkan semakan menyeluruh terhadap dokumen pemohon dan kelayakan kredit. Koperasi atau institusi kewangan yang bertanggungjawab untuk mengeluarkan pinjaman menilai risiko yang berkaitan dengan setiap permohonan.

5.4 Pengeluaran Dana:

Setelah diluluskan, jumlah pinjaman akan disalurkan ke akaun koperasi pemohon, yang kemudiannya boleh diakses untuk pelbagai tujuan, seperti perbelanjaan pendidikan, perumahan atau kecemasan.

Pinjaman Peribadi Islamik

- Jenis Pinjaman Koperasi Kerajaan Malaysia

Pinjaman Koperasi Kerajaan Malaysia menawarkan pelbagai produk pinjaman yang disesuaikan dengan pelbagai keperluan kakitangan kerajaan. Beberapa jenis biasa termasuk:

6.1 Pinjaman Peribadi:

Pinjaman peribadi adalah serba boleh dan boleh digunakan untuk pelbagai tujuan, termasuk penyatuan hutang, perbelanjaan perubatan atau pelaburan peribadi.

6.2 Pinjaman Pendidikan:

Pinjaman ini direka bentuk untuk menyokong perbelanjaan pendidikan, termasuk yuran pengajian, buku teks dan kos lain yang berkaitan. Ia membolehkan kakitangan kerajaan melabur dalam kemahiran dan kelayakan mereka.

6.3 Pinjaman Perumahan:

Pinjaman perumahan membantu kakitangan kerajaan mencapai pemilikan rumah dengan menyediakan dana untuk pembelian hartanah atau pembinaan rumah. Pinjaman ini selalunya datang dengan kadar faedah yang kompetitif dan syarat pembayaran balik yang menggalakkan.

6.4 Pinjaman Kenderaan:

Pinjaman kenderaan membantu kakitangan kerajaan dalam memperoleh kenderaan untuk kegunaan peribadi atau profesional. Mereka memudahkan mobiliti dan keperluan pengangkutan.

6.5 Pinjaman Kecemasan:

Pinjaman kecemasan direka bentuk untuk menyediakan bantuan kewangan yang pantas semasa krisis yang tidak dijangka, seperti kecemasan perubatan atau perbelanjaan yang tidak dijangka.

Setiap jenis pinjaman distrukturkan untuk memenuhi keperluan kewangan tertentu, memastikan kakitangan kerajaan mempunyai akses kepada kredit mampu milik untuk pelbagai tujuan.

- Kadar Faedah dan Syarat Pembayaran Balik

7.1 Kadar Faedah Tetap lwn. Berubah:

Kadar faedah untuk pinjaman Pinjaman Koperasi Kerajaan Malaysia boleh sama ada tetap atau berubah. Kadar tetap menawarkan kestabilan, dengan pembayaran balik bulanan yang konsisten, manakala kadar berubah mungkin berubah-ubah mengikut keadaan pasaran.

7.2 Tempoh Pembayaran Balik:

Tempoh bayaran balik berbeza-beza bergantung kepada jenis pinjaman dan terma koperasi. Ia boleh berkisar antara beberapa bulan hingga beberapa tahun, memastikan pembayaran balik sejajar dengan kapasiti kewangan peminjam.

7.3 Tempoh Ihsan:

Sesetengah pinjaman mungkin menawarkan tempoh tangguh sebelum pembayaran balik bermula, membolehkan peminjam menumpukan perhatian kepada keperluan mereka sebelum memulakan pembayaran balik. Tempoh tangguh ini amat bermanfaat untuk pendidikan dan pinjaman perumahan.

7.4 Penalti Pembayaran Lewat:

Untuk menggalakkan pembayaran balik tepat pada masanya, pinjaman biasanya disertakan dengan penalti untuk pembayaran lewat. Peminjam harus sedar tentang penalti ini dan berusaha untuk memenuhi kewajipan pembayaran balik mereka tepat pada masanya.

- Faedah Pinjaman Koperasi Kerajaan Malaysia

8.1 Kadar Faedah Berdaya saing:

Salah satu kelebihan Pinjaman Koperasi Kerajaan Malaysia yang paling ketara ialah kadar faedahnya yang kompetitif. Koperasi sering menawarkan kadar faedah yang lebih rendah berbanding bank perdagangan, menjadikan pinjaman lebih berpatutan untuk kakitangan kerajaan.

8.2 Pilihan Pembayaran Balik Fleksibel:

Program ini menyediakan pilihan pembayaran balik yang fleksibel, membolehkan peminjam memilih terma yang sejajar dengan kapasiti kewangan mereka. Fleksibiliti ini mengurangkan risiko kemungkiran pinjaman dan tekanan kewangan.

8.3 Rangkuman Kewangan:

Dengan menyasarkan kakitangan kerajaan dan bekerjasama dengan koperasi, Pinjaman Koperasi Kerajaan Malaysia menggalakkan rangkuman kewangan, memastikan sebahagian besar penduduk mendapat akses kepada perkhidmatan kewangan formal.

8.4 Kesan Sosial dan Ekonomi:

Kesan program ini melangkaui peminjam individu. Ia memupuk pertumbuhan koperasi, yang seterusnya menyumbang kepada pembangunan ekonomi tempatan, penciptaan pekerjaan, dan pemerkasaan komuniti.

Pinjaman Syariah

- Cabaran dan Kebimbangan

9.1 Liputan Terhad:

Salah satu cabaran ialah liputan terhad Pinjaman Koperasi Kerajaan Malaysia, kerana ia menyasarkan kakitangan kerajaan terutamanya. Memperluaskan akses kepada segmen penduduk yang lebih luas kekal sebagai cabaran.

9.2 Pinjaman Ingkar dan Pinjaman Tidak Berbayar:

Walaupun amalan pinjaman yang bertanggungjawab, sesetengah peminjam mungkin menghadapi kesukaran untuk membayar balik pinjaman mereka. Menguruskan kemungkiran pinjaman dan pinjaman tidak berbayar adalah kebimbangan berterusan.

9.3 Masalah Pentadbiran:

Proses permohonan dan kelulusan boleh memakan masa, dan kesesakan pentadbiran boleh menghalang kecekapan program. Memperkemas proses ini adalah penting untuk meningkatkan kebolehcapaian.

9.4 Persaingan dengan Bank Perdagangan:

Program ini bersaing dengan bank perdagangan untuk pelanggan, yang mungkin menjejaskan kemampanan dan keuntungan koperasi.

10.1 Kajian Kes Penerima:

Beberapa kajian kes menonjolkan impak positif Pinjaman Koperasi Kerajaan Malaysia ke atas individu benefisiari. Kisah-kisah ini mempamerkan bagaimana pinjaman telah membantu kakitangan kerajaan mencapai matlamat kewangan mereka.

10.2 Kesan terhadap Kesejahteraan Kewangan:

Penyelidikan dan tinjauan menunjukkan impak positif program terhadap kesejahteraan kewangan kakitangan kerajaan. Ia telah membantu individu menjimatkan wang, mengurangkan beban hutang dan meningkatkan kestabilan kewangan mereka secara keseluruhan.

10.3 Pertumbuhan Koperasi:

Pinjaman Koperasi Kerajaan Malaysia telah menyumbang kepada pertumbuhan dan kemampanan koperasi, memupuk rasa pemilikan dan pemerkasaan di kalangan ahli mereka.

- Sokongan dan Peraturan Kerajaan

11.1 Peranan Kementerian Pembangunan Usahawan dan Koperasi:

Kementerian Pembangunan Usahawan dan Koperasi memainkan peranan penting dalam menyelia dan mengawal selia koperasi di Malaysia. Ia menyediakan bimbingan dan sokongan kepada koperasi, memastikan mereka beroperasi mengikut undang-undang dan peraturan yang berkaitan.

11.2 Rangka Kerja Kawal Selia:

Akta Koperasi 1993 menyediakan rangka kerja perundangan untuk operasi koperasi di Malaysia. Perundangan ini menggariskan hak dan tanggungjawab ahli koperasi, struktur tadbir urus, dan pengawasan kawal selia.

11.3 Insentif Cukai:

Kerajaan Malaysia menawarkan insentif cukai untuk menggalakkan pertumbuhan koperasi. Insentif ini menggalakkan pelaburan dan penyertaan dalam koperasi, sejajar dengan matlamat pembangunan sosio-ekonomi yang lebih luas.

- Analisis Perbandingan dengan Produk Kewangan Lain

12.1 Pinjaman Bank Perdagangan:

Pinjaman Koperasi Kerajaan Malaysia berbeza dengan pinjaman bank komersial dari segi kadar faedah, kriteria kelayakan, dan struktur koperasi. Analisis perbandingan akan meneroka kelebihan dan kekurangan kedua-dua pilihan untuk peminjam.

12.2 Institusi Kewangan Mikro:

Institusi kewangan mikro juga melayani penduduk yang kurang mendapat perkhidmatan, tetapi model pinjaman dan demografi sasaran mereka berbeza daripada Pinjaman Koperasi Kerajaan Malaysia. Perbandingan akan mendedahkan ciri unik kedua-dua pendekatan.

12.3 Pilihan Simpanan dan Pelaburan Peribadi:

Meneliti bagaimana Pinjaman Koperasi Kerajaan Malaysia dibandingkan dengan simpanan peribadi dan pilihan pelaburan akan membantu individu membuat keputusan kewangan yang termaklum. Analisis ini akan mempertimbangkan faktor seperti risiko dan pulangan.

- Prospek dan Inovasi Masa Depan

13.1 Kemajuan Teknologi:

Penyepaduan teknologi dalam proses permohonan dan kelulusan boleh meningkatkan kebolehcapaian dan kecekapan. Apl mudah alih, platform dalam talian dan dokumentasi digital boleh menyelaraskan operasi.

13.2 Perluasan Kriteria Kelayakan:

Meluaskan jangkauan program untuk memasukkan lebih ramai pekerja sektor awam atau memperkenalkan produk pinjaman khusus untuk keperluan yang berbeza boleh diterokai.

13.3 Amalan Lestari:

Amalan kemampanan, seperti pembiayaan hijau dan pinjaman beretika, boleh disepadukan untuk sejajar dengan matlamat kemampanan global dan nasional.

- Kesimpulan

14.1 Kesan dan Kepentingan:

Pinjaman Koperasi Kerajaan Malaysia mempunyai kepentingan yang besar dalam landskap koperasi Malaysia dan kesejahteraan kewangan kakitangan kerajaan. Kesannya terhadap pemerkasaan kewangan, pertumbuhan koperasi, dan pembangunan sosio-ekonomi patut diberi perhatian.

14.2 Cabaran dan Peluang:

Walaupun program ini menghadapi cabaran seperti liputan terhad dan kebimbangan kemungkiran pinjaman, terdapat peluang untuk inovasi, pengembangan dan kecekapan pentadbiran yang dipertingkatkan.

14.3 Jalan Hadapan:

Masa depan Pinjaman Koperasi Kerajaan Malaysia harus menumpukan pada meningkatkan kebolehcapaian, menggalakkan pinjaman yang bertanggungjawab, dan memanfaatkan teknologi untuk mewujudkan ekosistem kewangan yang lebih inklusif dan mampan untuk kakitangan kerajaan dan koperasi.

- Rujukan

Senarai komprehensif rujukan akan disertakan, menampilkan penyelidikan akademik, laporan kerajaan, dokumen dasar dan kajian kes yang menyokong analisis yang dibentangkan dalam dokumen ini.

Analisis terperinci Pinjaman Koperasi Kerajaan Malaysia ini memberikan pemahaman yang menyeluruh tentang sejarah program, objektif, kriteria kelayakan, proses permohonan, faedah, cabaran dan prospek masa depan. Ia menjelaskan bagaimana inisiatif ini menyumbang kepada kesejahteraan kewangan kakitangan kerajaan dan gerakan koperasi di Malaysia, akhirnya memupuk pembangunan sosio-ekonomi negara.

Name: Koperasi 1 Malaysia

Address: 12-2, Jalan Rimbunan Raya, Laman Rimbunan Kepong, 52100 KL

Phone Number: 012-505 6915

Email: [email protected]

Google Map Location: Click here

Linktree: Pinjaman Koperasi

Blog: Pinjaman Koperasi

Blogspot: Pinjaman Koperasi

Google: Pinjaman Koperasi